New strategy stresses execution and the value of core telco assets and attributes

The refrain of My Back Pages, recorded by Bob Dylan in 1964 is:

Ah, but I was so much older then

I’m younger than that now.

The song acknowledges his more naïve, younger self thought he had all the answers, but things are more complicated than he had realised. Now some disillusionment is accompanied by an understanding that we have to look at things as they truly are – l’actualité – rather than as we’d like them to be.

At Thursday’s Capital Markets Day the Orange group’s incumbent CEO Christel Heydemann and her team reset the Engage2025 strategy laid out by her predecessor, Stéphane Richard, in December 2019 on the eve of the COVID pandemic. The new strategy, Lead the future, covers the period to 2025 and is the foundation for what will be achieved up to 2030.

The central axis is that telecoms are essential and that its future lies with an old industry being rejuvenated – and Heydemann places great emphasis on execution, perhaps from her long experience in industry. She is also hopeful about what look to be some profund regulatory changes that are on the way, at European level at least.

Rejuvenating what’s essential

She said, “When I joined the company, my first reaction was that we cannot leave this business which is so essential for the future, for resilience, for strategic independence. How come we have an entire industry that has tried to diversify to find growth? There’s something wrong in the model. That’s why we have to make sure that we create value from…next-generation infrastructure” while keeping control of strategic assets, like Orange’s Totem towerco, for instance.

The rejuvenation includes decommissioning 2G and 3G networks and closing down its copper local loop in France at least by 2030. This Heydemann said is due to Orange’s foresight in building fibre out way ahead of most of its counterparts in the other large European economies, before the impetus of the pandemic.

Orange met all its guidance in Q4 and for the full fiscal year which is no mean achievement in what everyone is calling “significant headwinds”, but like all major European operator groups – and many other service providers around the world – it remains mired in debt while grand plans to fuel anything beyond incremental growth have floundered.

In Orange’s case, the debt from its telecoms activities stands at €25,298 billion for fiscal year 2022, up from €24,269 for fiscal year 2021, and at a ratio of 1.93 financial debt to EBITDAaL of telecom activities, up from a ratio of 1.91 in 2021.

Central conundrum

The fundamental issue of where the money is going to come from to change this remains unsolved.

Whereas Richard was looking for the main engines of growth to be other than established telco services, in Heydemann’s view, the updated versions enabled by next-generation infrastructure are where Orange’s future lies. Hence during her 10 months in the job, Heydemann has started shedding non-core activities: Orange started negotiating the sale of video content firms OCS and Orange Studio and is looking at all options for its loss-making Orange Bank, including selling it. Heydemann’s only mention of it at Capital Markets Day was that she expected it to break even in 2025-2026.

There are four pillars to the new strategy:

• maintaining fundamental good business practices;

• creating value and profiting from investments in fibre and 5G networks;

• maintaining the relatively high growth rates Orange has achieved in its African and the Middle Eastern markets for the last few years; and

• Orange Business Services, which henceforth will be known as Orange Business.

Business in the driving seat?

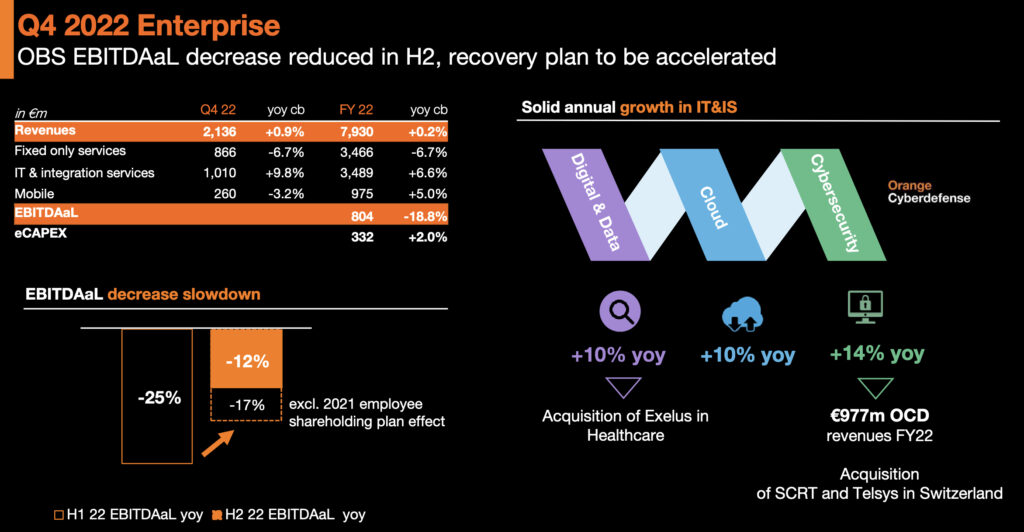

Orange Business was also seen as a major driver of Orange group’s fortunes by Richard, but is somewhat adrift. Fixing it falls largely to Aliette Mousnier-Lompré who became CEO of Orange Business Services in January. She has worked at Orange for almost six and a half years, most recently as SVP Customer Services & Operations before her promotion.

Mousnier-Lompré said dropping the Services from the unit’s title represented “the simplification and the focus we want to achieve”. Under the previous regime, the goal was for Orange Business Services to become an integrator, offering ICT to businesses as well as connectivity. It has achieved its target. Digital capabilities, she said, had accounted for 29% of Orange Business Services’ activities in 2015 and now are at 44%. This is not cause for rejoicing, however.

The consequent “operational execution challenges” translated into a 32% EBITDA decline over three years, Mousnier-Lompré pointed out. Note again that stress on execution. She explained, “This change in activity mix has not only very seriously impacted our gross margin mix, it has also converted Orange Business into a kind of hybrid object: half telco, half digital company”.

Hence the situation “calls for a decisive overhaul of the Orange Business operating model,” she added. Now here’s the real heart of the matter, from BT Global (it too dropped the Services) and BT Enterprise, to Deutsche Telekom’s T-Systems, telecos’ track record at providing ICT services to businesses has not been far from a roaring success so far.

Will the strategy cut it?

Mousnier-Lompré’s solution is to massively simplify the product portfolio, chop the management team down from 17 to 12 members and introduce some new blood from outside, make “ambitious” savings and reskilling and upskilling more than 5,000 staff – although the consultation with “social partners” also known as trades unions will start next month.

Cyberdefence will play a big role in the rejuvenated Orange Business with a revenue target of €1.3 billion for 2025.

Mousnier-Lompré stated, “We aim at being a leading and high-performing network and digital integrator. We clearly have the assets to do so, and we will adapt our operating model and cost structure accordingly. It will be done through a structured action plan on which we regularly report progress.”

That doesn’t look like a new business model so much as shuffling some admittedly substantial cards. We will watch with interest.