Proposed measures don’t address many basic consumer concerns, but could help operators reset their business models as well as their price rises

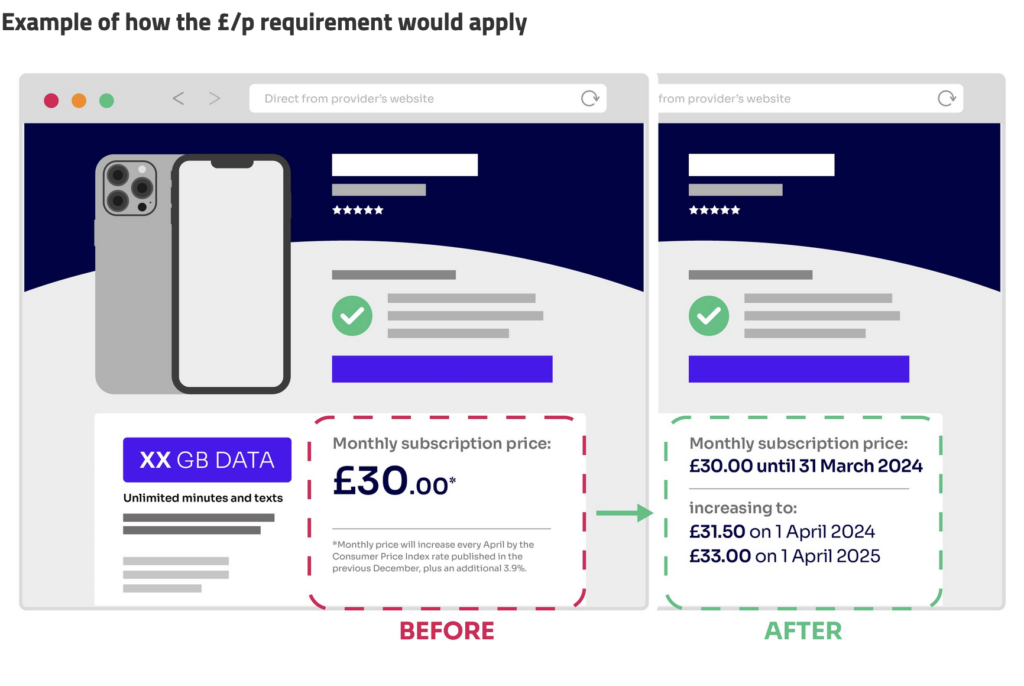

Ofcom has ruled that potential customers for phone, TV and broadband services must have any mid-contract price rises set out for them in “pounds and pence” before signing contracts.

The decision is the result of a review launched in February after complaints about mid-contract price hikes, which are typically above the rise in inflation.

While it is usual for service providers to explain in the small print that monthly charges will rise in line with inflation, but in the last year, prices have risen more steeply than in previous years, hitting consumers hard during a cost of living crisis.

According to Ofcom, as of April this year, four out of 10 broadband customers and about 36 million mobile customers were subject to inflation-linked price rises.

However, the practice of imposing an annual rise linked to the rate of inflation, plus an additional 3.9% is proliferating and “undermining customers’ understanding of what they will pay,” according to Dame Melanie Dawes, the head of Ofcom.

Hence the regulator will insist on price rises being given in actual monetary amounts rather than percentages.

They are all at it

Dame Melanie gave the most recent example of this, pointing out that in May, Virgin Media O2, levied inflation-linked price rises for landline and broadband services. The rise reflected the Retail Prices Index (RPI) measure of inflation which was 11.3% at the time plus 3.9%.

In March, Tesco’s charges rose 10.1%, the Consumer Prices Index (CPI) inflation measure back then, plus 3.9%. BT, Vodafone and EE have been using such practices since 2020.

Ofcom has received more than 800 complaints related to contract price increases between January and October – close to double the number during the same period in 2021. The image, supplied by Ofcom, shows how price increases should be set out for prospective customers before they sign up for services.

Arguably not understanding abbreviations like RPI and CPI is not the issue so much as consumers feeling all service providers are as bad as each other regarding hiking prices mid-contract and that there is no way of avoiding the increases.

Secondly, that they need the services, so they’ll just have to manage somehow.

And thirdly, where’s Ofcom’s ruling on operators banging 3.9% on top of the rate of inflation? Some would describe that as profiteering.

And fourthly, how can operators know how much inflation will rise in future to provide the numbers in pounds and pence, and might this not encourage them to err on the side of caution – that is cover their backs with higher price rises?

It’s not clear how Ofcom’s proposed measures address any of these issues, and a bit surprising that the Consumers Association thinks this is a “huge win for consumers”.

Lower over time

Ofcom did point out that while some broadband prices had increased, average costs for internet access and mobile services in the UK had fallen over the past five years, when compared with the rate of inflation.

A consultation will now run Ofcom’s proposals until 13 February. The regulator intends to to publish its final decision next 2024 – just a year after kicking the whole thing off.

Big chance for reset by operators?

So how will the proposals affect the operators? According to Claudio Costa, Senior Director, Telco, at NTT DATA UK and Ireland, “Telecom companies must see this as a pivot point, a chance to innovate and adapt. By leveraging AI and automation, we can create more efficient operational models ahead of the contract being signed – rather than during the contract itself.”

He thinks this would improve customers’ trust in operators and help the operators build “a sustainable competitive advantage”. This is assuming service providers see adhering to Ofcom’s proposed rules as a chance to rethink pricing structures with sustainability and customer-centricity top of mind.

Costa continues, “Telcos will not achieve the necessary results through ad hoc actions. There needs to be a coordinated, strategically managed approach. An approach that provides the structure, discipline, resources, skills, tools, teamwork and accountability of a cost transformation programme, to drive the process and yield the outcomes over the short and long term.

“Telecoms have always been at the forefront of technological innovation. Now, it’s time to apply that same mindset to our business strategies.”