Rival operators who suspect EE has gained a significant advantage over its rivals by deploying LTE in 1800MHz spectrum may have had their fears confirmed by a senior network economist at Deutsche Telekom (DT).

David Haszledine, Network Economics Manager at DT, told Avren Events' HetNet conference that rolling out an LTE network in 1800MHz spectrum could be a quarter or a fifth as cheap as achieving the same network in 2.6GHz spectrum.

In Austria, where T-Mobile has an obligation to provide 25% population coverage via LTE at 2.6GHz, the budget submission from the network team was "painful", Haszeldine said*. In-building coverage in areas of thick-walled buildings was proving particularly problematic, he said.

Asked by Mobile Europe what the submission might have looked like if T-Mobile Austria had, like its EE cousin in the UK, 1800MHz spectrum to work in, Haszeldine said, "I have to be careful because I have seen cost comparisons of 800MHz, 1800MHz and 2.6GHz LTE that are so secret there are no electronic copies. But I will say that 1800 is cheaper by factors, perhaps by a quarter or a fifth."

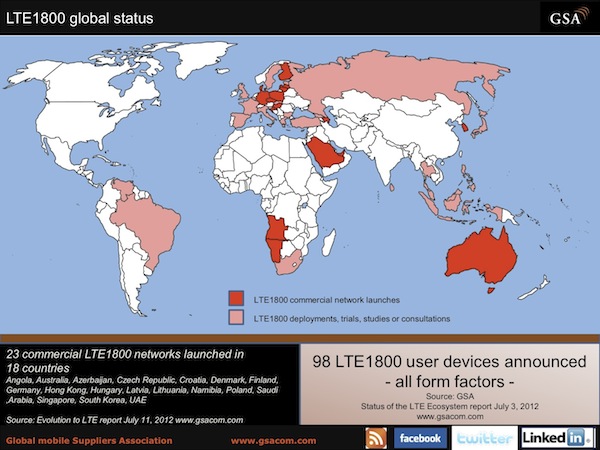

"I think that 1800 will become the de facto LTE standard, not just because of the iPhone 5 but because of the business benefits if offers operators," he said. Of course, network economics also put a premium on the digital dividend 800MHz spectrum that Ofcom is auctioning, and may drive the price of that spectrum up accordingly.

2.6GHz LTE could find a use as a tactical tool to infill specific capacity requirements, he added. "It's a tactical game, find out were cells are busy and why they are busy, and don't throw money where you don't need to," he said.

"I'm trying to get the dinosaurs I speak to to understand this. But dinosaurs don't change their spots," he added. He also likened radio access teams to children being let loose in a toy shop, and said "dinosaurs" need to realise that the business has changed, and that every operator is "feeling the pinch".

He positioned his comments in the context of a mobile operator that might see its ARPUs fall by half in the medium term, while data volumes, at present, grow 50% year on year. Controlling costs, and targeting investment, will be critical in such a future, he said. Those economics, added to the fact that most networks see a large proportion of their traffic come from a small percentage of their sites – leaving a long tail of unprofitable sites – make network sharing and consolidation inevitable.

* Painful might be good, though. Haszeldine described T-Mobile USA's LTE network rollout plans as "eye-watering".