Trials are ramping up, so when will the promises of network slicing become reality?

Network slicing – which sees a portion of the network allocated to a specific use case – offers the potential to substantially boost mobile operator revenue.

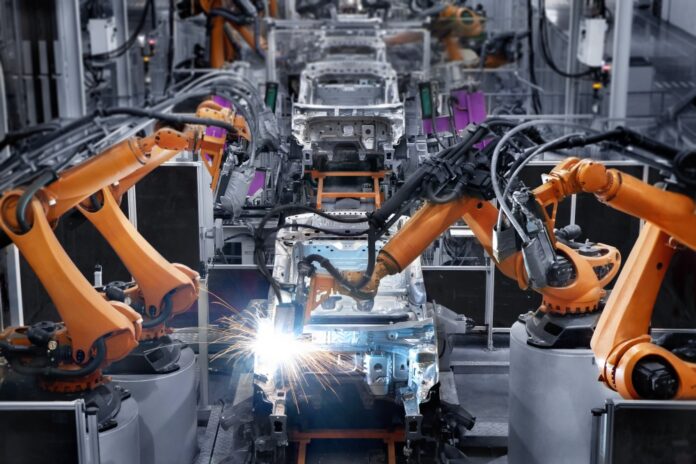

As each slice can be customised to fit specific needs, the technology stands to benefit multiple use cases and applications. According to ABI Research, 5G network slicing will generate $66 billion in value for enterprises in verticals including manufacturing, logistics and transportation by 2026. Consequently, it’s no surprise that trials are ramping up across the globe.

In July, Telefónica, Ericsson and Google claimed to have automated the process of end to end network slicing needed for the mass provision of a 5G standalone (SA) network, including lifecycle support and radio resource portioning. The successful lab test demonstrated the ability to provision a network slice from the core to the radio access network (RAN) in 35 minutes.

In September, Vodafone Netherlands said it had become the first telecoms company in the country to introduce network slicing. Earlier this year, A1 Telekom Austria Group’s trial with software provider Amdocs showed how 5G network slices could be deployed and generate revenue.

Yet despite the obvious benefits, the technology still faces multiple regulatory, business and technical challenges. When will the promises of network slicing become reality?

The reality of network slicing

The reality of network slicing depends on a number of factors; one is the standalone version of 5G. Very few mobile operators have so far invested in 5G standalone networks, says Aaron Partouche, Global Vertical Principal Director, Colt Technology Services.

As a result, the ecosystem and use cases are still emerging. “If operators are going to deliver all of the promises 5G brings – particularly ultra-reliable low-latency communications – network slicing and a developed ecosystem will be critical,” says Partouche.

Adding to this, there hasn’t been much promotion of network slicing from mobile operators – nor have they been defining how they are going to deliver solutions from a commercial point of view, says Adrian Belcher, Solutions Architect at Gigamon.

“While the technology is certainly ready and embedded into 5G network equipment, 5G itself faces delays and therefore so do all the components that go with it. There are of course a few fully formed 5G standalone networks being deployed now, but a lot more are still in late lab trial phase,”he notes.

Complexity is the enemy

The complexity of network slicing is another big challenge. “Slicing runs across domains, from RAN to transport and core, and it needs complex vertical and horizontal integrations,” says Manish Mangal, Global Business, Head of 5G and Network Services at Tech Mahindra.

“There is also a need for virtualisation, software defined networking (SDN) and orchestration capabilities. Resource allocation, sharing and Isolation among slices adds to the complexity.”

Security also needs to be resolved and is a tricky matter due to resource sharing among slices, says Deepak Sharma, Senior Manager, Product Portfolio at Tecnotree. “Network slices serving different types of services may need to adhere to different levels of security policy requirements. Therefore, while designing network slicing security protocols, it is necessary to consider the impact on other slices – and on the entire network.”

Implementation of end-to-end network slicing requires a redesign of the RAN and currently, there is no consensus for the best way of doing this, says Richard Webb, Director, Network Infrastructure, CCS Insight.

In addition, he says, deploying more network slices over the same physical infrastructure can create added difficulties for operators in maintaining service level agreements, quality of service and security assurance for each individual slice.

Taking this into account, Webb says network slicing is “in its relative infancy” with successful examples “yet to be established for all live deployment use cases”. For example, he says, one of the more challenging scenarios could require network slices to be maintained while roaming between private and public networks. “Establishing best practice for this type of requirement will be an important drive of market maturity.”

Progress and trials

Progress might not be rapid, but network slicing trials and projects are gaining pace this year and into next. Mika Uusitalo, Head of New Technologies and Innovations at Nokia, thinks “real momentum” has started to build on the network slicing journey.

He cites the example of several deployments and trials with Nokia’s customer base including Telia, A1, Orange, Mobily, Proximus, Safaricom, Cellcom and VI. “While there is always buzz and anticipation around new technologies, in practice it takes time to put the key building blocks in place,” Uusitalo concedes.

At the same time, network slicing is certainly a focus for the industry as 5G standalone enters the fray. Standards body the 3GPP has recognised network slicing to be an essential overall component of 5G. This has made it an ongoing focus for working groups developing 5G core architecture with network slicing as an integral feature, says Webb.

Slow standardisation

Standardisation of network slicing by 3GPP only happened “quite recently” at the beginning of 2020, points out Williams Tovar, 5G Media Streaming Solutions Director, Ateme. “It takes some time for infrastructure and application vendors to adapt.”

And progress could happen as quickly as next year, Tovar predicts. In 2023, he expects “a few” standalone 5G networks to be deployed, slicing to be tested, and commercial proposals for the first adopters. “In 2024 and beyond, I expect the growth of slicing adoption and the development of new applications,” Tovar adds.

There’s no doubt network slicing is a complex concept and for it to work from a business point of view, operators need to get it right. While network slicing is already a reality, it will take time to evolve, says Webb. “Standards should help this evolution, as well as the continuing development of some of the network environments in which slicing will be deployed, such as 5G private networks.”