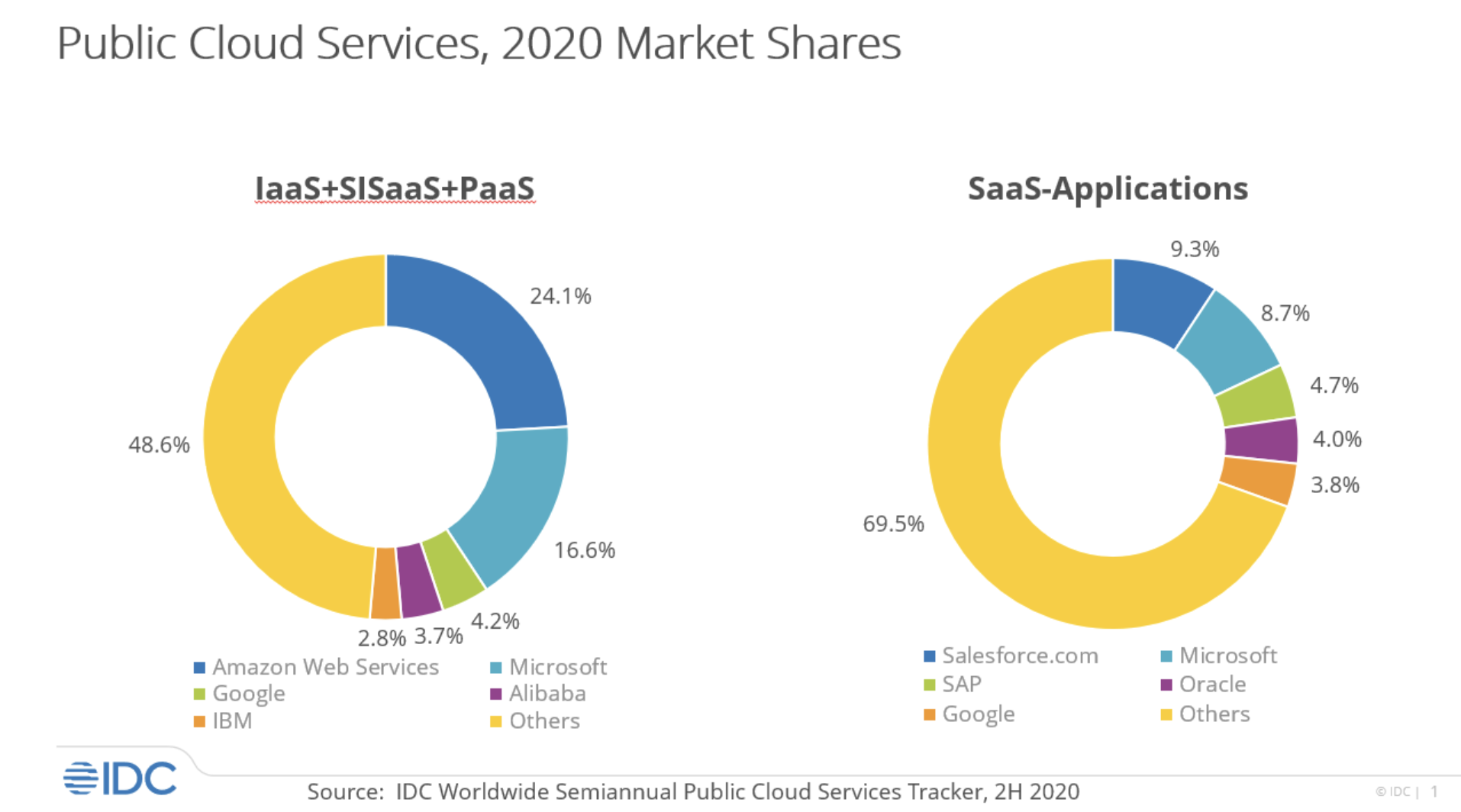

Amazon Web Services and Microsoft are vying for the top spot, according to IDC.

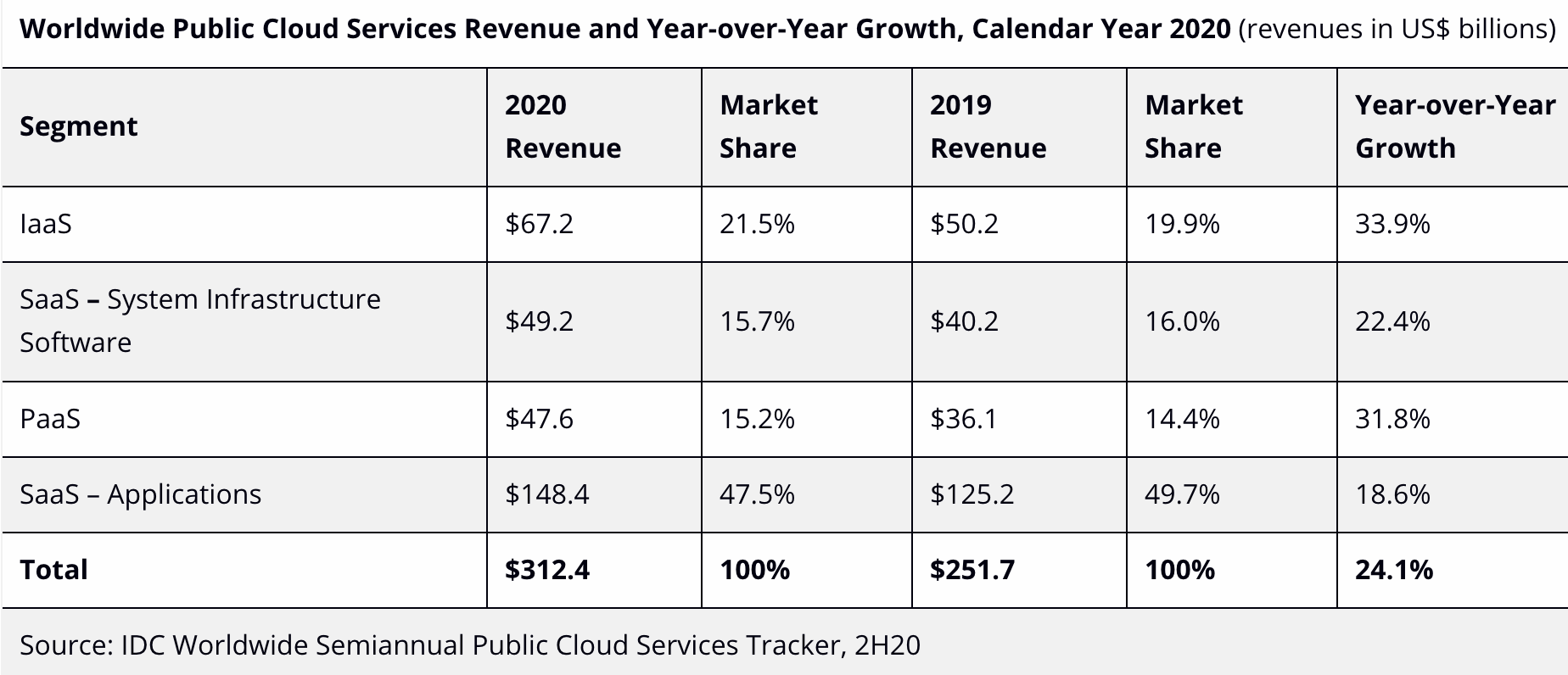

The worldwide public cloud services market grew 24.1% year on year in 2020 with revenues totaling $312 billion (€19.95 billion), according to the International Data Corporation (IDC) Worldwide Semiannual Public Cloud Services Tracker.

This includes Infrastructure as a Service (IaaS), System Infrastructure Software as a Service (SISaaS), Platform as a Service (PaaS), and Software as a Service (SaaS).P

The combined revenue of the top five public cloud service providers (Amazon Web Services, Microsoft, Salesforce.com, Google, and Oracle) accounted for 38% of the worldwide total, rising 32% year on year.

Due to an expanding portfolio of SaaS and SISaaS offerings, Microsoft now shares the top position with Amazon Web Services in the whole public cloud services market with both companies holding 12.8% revenue share for the year.

Navigating disruptions

“Access to shared infrastructure, data, and application resources in public clouds played a critical role in helping organizations and individuals navigate the disruptions of the past year,” said Rick Villars, Group VP Worldwide Research at IDC.

“In the coming years, enterprises’ ability to govern a growing portfolio of cloud services will be the foundation for introducing greater automation into business and IT processes while also becoming more digitally resilient.”

Overall public cloud services market grew 24.1% in 2020, consistent with the past four years, while the IaaS and PaaS segments have consistently grown at much faster rates.

Cloud foundations

This highlights the increasing reliance of enterprises on a cloud foundation built on cloud infrastructure, software defined data, Compute and Governance solutions as a Service, and cloud-native platforms on which enterprises deploy internal IT applications.

IDC expects spending on foundational cloud services (especially IaaS and PaaS) will continue growing at a higher rate than the overall cloud market as resilience, flexibility and agility guide IT platform decisions.

“Cloud service providers are rapidly expanding their portfolio of infrastructure and platform services to address confidential computing, performance intensive computing, and hybrid deployment scenarios,” said Dave McCarthy, VP, Cloud and Edge Infrastructure Services at IDC.

Lara Greden, Research Director, Platform as a Service at IDC added, “Extending these foundational cloud services to customer premises and communications networks enables a broader set of use cases than previously possible.”

“The high pace of growth in PaaS, IaaS, and SISaaS, which combined account for about half of the public cloud services market, reflects the demand for solutions that accelerate and automate the development and delivery of modern applications”.

IoT and edge progress

“As organizations adopt DevOps approaches and align according to value streams, we are seeing PaaS, IaaS, and SISaaS solutions…increasingly adopted and, at the same time, grow in the range of services and thus value they provide. Innovations in edge and IoT use cases are also contributing to the faster rates of growth in these markets.”

Frank Della Rosa, Research Director, SaaS and Cloud Software at IDC said, “SaaS applications is the largest and most mature segment of public cloud with 2020 revenues of $148 billion.

“Organizations across industries hastened the replacement of legacy business applications with a new breed of SaaS applications that is data-driven, intuitive, composable, and ideally suited for more distributed cloud architectures. Organizations looking for industry-specific applications can choose from a growing assortment of vertical applications.

“The SaaS apps market is dominated by a longtail of providers that account for 65% of the total market”.

Combination tells a story

Looking at the segment results, a combined view of IaaS, SISaaS, and PaaS spending is relevant because it represents the foundational set of services that end customers and SaaS companies consume when running, modernising, building, and governing applications on shared public clouds.

In the combined IaaS, SISaaS and PaaS market, the top 5 companies (Amazon Web Services, Microsoft, Google, Alibaba, and IBM) captured over 51% of global revenues. But there continues to be a healthy long tail, representing nearly half the market total.

These are companies with targeted use case-specific PaaS services or cross-cloud compute, data, or network governance services. The long tail is even more pronounced in SaaS, where customers growing focus on specific outcomes ensures that over two thirds of the spending is captured outside the top 5.

IDC’s Worldwide Semiannual Public Cloud Services Tracker looks at 500 cloud services companies across 49 countries.