Gartner expects an 89% increase by 2020 compared with 2019 revenues of $2.2 billion.

The research house said 7% of network operators around the world have already deployed 5G in their networks.

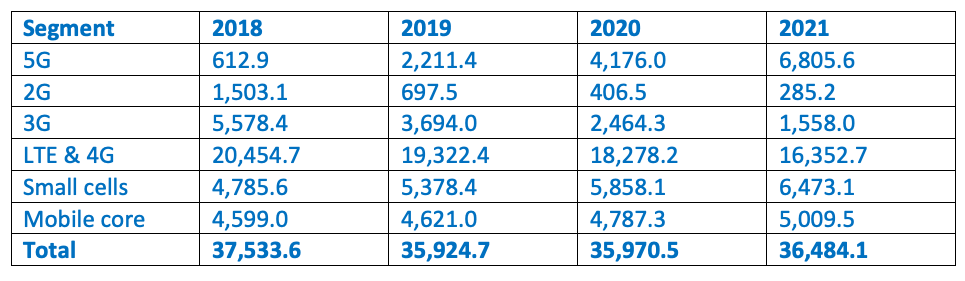

Gartner also predicts investments in 5G New Radio (the standard released by 3GPP at the end of 2017) network infrastructure will account for 6% of the total wireless infrastructure revenue network operators in 2019, and that this figure will reach 12% in 2020 (see table below).

“5G wireless network infrastructure revenue will nearly double between 2019 and 2020,” according to Sylvain Fabre, Senior Research Director at Gartner.

“For 5G deployments in 2019, CSPs [communications service providers] are using non-stand-alone technology. This enables them to introduce 5G services that run more quickly, as 5G [NR] equipment can be rolled out alongside existing 4G core network infrastructure.”

In 2020, network operators will roll out stand-alone 5G technology, which will require 5G NR equipment and a 5G core network. The aim is to lower their costs and improve performance for users.

Wireless infrastructure revenue forecast worldwide 2018-2021, in millions of dollars

Source: Gartner (August 2019) Due to rounding, figures may not add up precisely to the totals shown.

5G services have been rolled out and will be deployed progressively this year in Switzerland, Finland and the UK, while operators in France, Germany, Spain and Sweden all intend to accelerate the build-out of 5G during 2020.

Shift to enterprise and private nets

Although consumers are the main market for 5G deployment so far, increasingly 5G services will be created for enterprises, for applications like the smart factory, autonomous transportation, remote healthcare, agriculture and retail sectors, plus private networks for some industries.

Indeed, Gartner says that equipment vendors should view private networks for industrial users as a market segment with significant potential.

“It’s still early days for the 5G private-network opportunity, but vendors, regulators and standards bodies have preparations in place,” said Fabre.

In Europe, Germany has set aside the 3.7GHz band for private networks, and Japan is reserving the 4.5GHz and 28GHz for the same purpose.

Different approaches

It adds that Ericsson plans to deliver solutions via operators to build private networks with high levels of reliability and performance, and security.

Nokia has taken a different tack and developed a portfolio to enable large industrial organisations to invest directly in their own private networks.

“National 5G coverage will not occur as quickly as with past generations of wireless infrastructure,” said Fabre. “To maintain average performance standards as 5G is built out, CSPs will need to undertake targeted strategic improvements to their 4G legacy layer, by upgrading 4G infrastructure around 5G areas of coverage.”

Gartner warns that a less robust 4G legacy layer adjoining 5G cells could lead to real or perceived performance issues as users move from 5G to 4G and LTE Advanced Pro.

This will be most evident between 2019 and 2021, when 5G coverage will primarily be used for hot spots and better coverage of high population density.