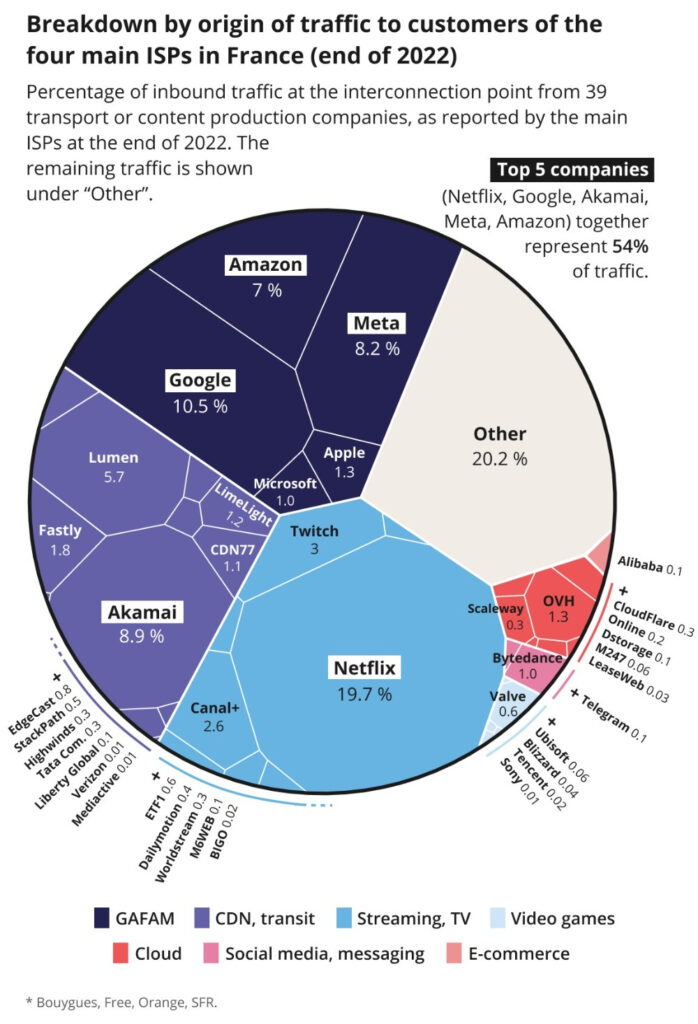

Regulator Arcep says Netflix, Google, Akamai, Meta and Amazon are in the internet box seat in France

More than half of the traffic to the customers of France’s largest ISPs comes from five companies, according to French regulator Arcep.

In 2022, 54% of the traffic to the customers of France’s largest ISPs came from five companies: Netflix, Google, Akamai, Meta and Amazon. The remainder (46%) came from a wide variety of players that interconnect with ISPs.

The numbers were revealed in the regulator’s latest interconnection report. In the past decade, incoming interconnection traffic to the country’s four main ISPs has increased by 20 times, reaching 43.2Tbps at the end of 2022 (+21.5% YoY). Around half of this traffic comes from transit links on Orange’s backbone, private peering represents 48.5% of the inbound traffic and public peering accounts for 2%.

By the end of 2022, outbound traffic on the networks of France’s four main ISPs stood at around 3.8Tbps, or 30% more than at the end of 2021. This traffic increased by roughly sevenfold between 2012 and 2022. Video and content drives much of the asymmetry between inbound and outbound traffic.

Installed interconnection capacities have increased at the same pace as inbound traffic. Installed capacity at the end of 2022 is estimated at around 108Tbps, or 2.7 times the volume of inbound traffic.

Peering versus transit

Although peering’s share of the total traffic volume has been increasing steadily, between the end of 2020 and the end of 2022, peering’s share has been decreasing: from 53% at the end of 2020 to 52% at the end of 2021, and down to 50% at the end of 2022. The situation is due, on the one hand, to the increase in transit traffic (including traffic from Open Transit International) and, on the other, to some of the peering traffic being replaced by traffic coming from on-net CDNs.

These on-net CDN can either belong to the operator that hosts them, or to a third party. The most notable examples are the Netflix Open Connect Appliance and Google Global Cache servers. In addition to bringing content closer to end users, the use of an on-net CDN installed inside an ISP’s network creates the ability to upload video content to servers during off-peak times, instead of waiting to satisfy user requests for it during peak hours.

Between the end of 2021 and the end of 2022, traffic coming from on-net CDNs to the top four ISPs’ customers continued to increase, to reach around 10 Tbps.

Traffic breakdown and price declines

Although Arcep doesn’t capture content hosted via a CDN or third-party hosting company where there is no direct interconnection, it still throws up some interesting trends. For example, several CDNs have become big traffic originators, as has Lumen, which has gone from representing around 3% of inbound traffic to around 6%.

Even if price ranges are the same by and large (from under 5 eurocents to a few euros, excl. VAT, per month and per Mbps), the fees charged for transit services decreased slightly in 2022 – aligning with the trend of the past 10 years. For paid peering, prices continue to range from around €0.20 (excl. VAT) to several euros (excl. VAT) per month and per Mbps.

On-net CDNs are free in most cases. They can, however, be charged for as part of broader peering agreement, that the content provider has contracted with the ISP.