Shares hit lowest level since 2017 when Börje Ekholm (pictured) became CEO as there looks to be little relief this side of 2025

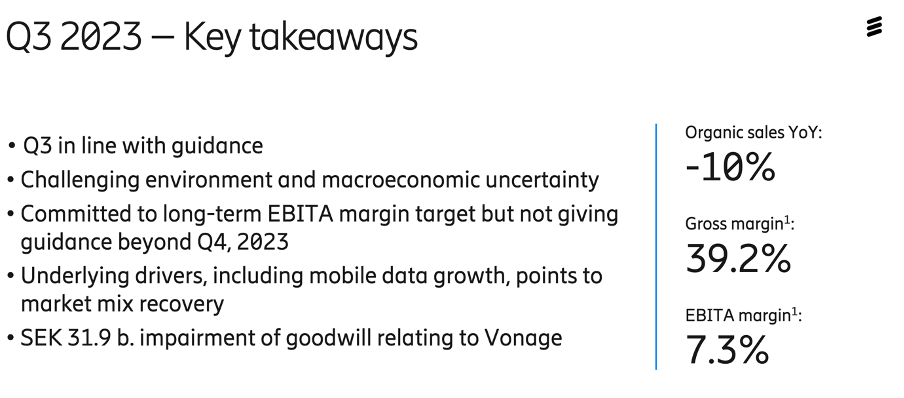

Ericsson’s Q3 results, formally announced today, are not pretty reading. Its shares dropped 9%, to the lowest level since 2017, after it posted a net loss of SEK30.67 billion (€2.66 billion). A year ago it made a profit of SEK5.21 billion (€452 million). That SEK31.9 billion reduction in Vonage’s value, down from the €6.2 billion it paid less than two years ago, was the instant shocker when it was announced last week.

The second severe blow is a 10% drop in year-on-year sales once currency fluctuations are smoothed out and the third is a more than 50% drop in revenues from the US network equipment market. North America accounted for 23% of Ericsson’s sales in Q3 compared with 48% a year earlier. The big 5G RAN roll-out is over and network operators are dealing with their ‘extra’ inventory from higher spending during and right after the pandemic.

Uncertainty continues

Overall, the company said it expects the uncertainty around the mobile market to continue into next year, with results in Q4 similar to those announced today. CEO, Börje Ekholm, said Ericsson, “remains committed to our EBITA margin of 15-18% and remains committed to getting there as soon as possible.

“However, given that our customers are cautious on investments in a current uncertain market environment, we will not give guidance beyond Q4 of this year. We have started to see more positive discussions with operators about network investments but it’s clearly too early to call this a turning point.”

As shown by the Ericsson figures above, the EBITA margin is less than half that target.

India was a bit of bright spot, but here too revenues dropped, by 17% to SEK41.5 billion, with Ericsson’s operating margin contracting to 11.1%, from 19.9% a year earlier, as it enters the physical work phase of deployment.

Better at cutting costs?

CFO Carl Mellander said the company had increased its cost saving target of SEK 11 billion Swedish crowns, which includes making 8,500 people redundant, to SEK12 billion.

It’s pretty dispiriting that the CFO says, “We have proven that cost cutting is something we are good at…should the market and our financial performance require it, we can do more.”

Vonage the saviour?

Meanwhile, Ekholm thinks Vonage will be Ericsson’s salvation. He said this “globally scalable” network platform is a “one-stop shop for both communication APIs, such as voice, SMS two factor authentication and enhanced security” as well as for network APIs like location device. He said, “Through the global network platform, we’re creating a new market for exposing 5G capabilities, an opportunity that…analysts estimate to be about $20 billion by 2028. And we aim to capture a sizable part of the market.”

Despite almost halving Vonage’s value, its sales were up 44% in Q3, to SEK4.2 billion. Much has been made of the deal last month with Deutsche Telekom, whereby Vonage is acting as the portal for the operator’s commercial API service. The trouble is, this only a drop in Ericsson’s leaky bucket, amounting to about 7% of overall turnover.

Also, there is a huge ground swell behind CAMARA, the GSMA’s initiative to define and develop standardised network interfaces. Whether or not that bears fruit, and when, remains to be seen. Ericsson is hoping that the likes of Vonage will be more agile and grab market share while the standards process grinds on.

Whether Vonage or CAMARA or any other party comes out on top, we’re still only talking about low tens of billions from API revenues, no matter which analyst house you believe, for the entire global telecoms industry – rather less than many of their individual piles of debt.