Nokia Siemens Networks (NSN) and Ericsson third quarter results appeared to show Ericsson benefiting more in sales terms from modernisation programmes within Europe operators, but suffering a slight hit to margins as a result. NSN’s European sales were down sequentially but the company achieved increased operating margins overall.

Ericsson saw Western and Central Europe sales increase 7% year-over-year and 6% sequentially, mainly driven by increased volumes related to network modernisation projects as operators replace GSM and WCDMA base stations with multi-standard radio solutions. The vendor said it is also seeing good momentum for managed services and network sharing as operators seek to reduce operating expenses.

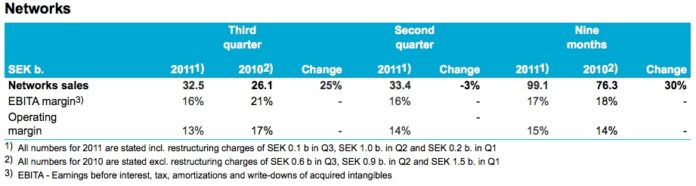

Ericsson’s network sales in the quarter were SEK 32.5 billion, an increase of 25% on the same period in 2011. Ericsson said there were high sales in mobile broadband related equipment including packet core, IP routers and microwave based backhaul. All regions except North America, Northern Europe & Central Asia, Mediterranean and India showed sequential growth in Networks.

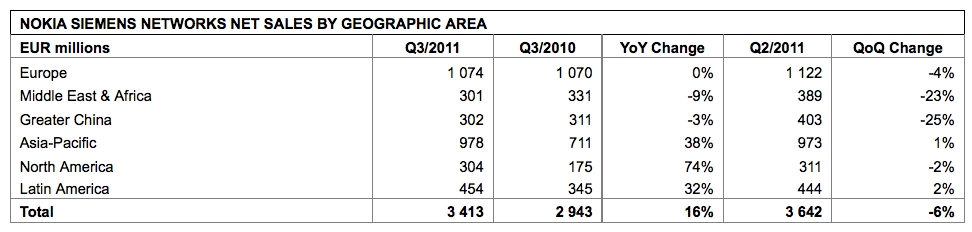

NSN, meanwhile, saw total net sales grow 3% year on year, excluding its Motorola Solutions acquisition, but in Europe it saw its 3Q sales drop 4% quarter on quarter and remain level on a year on year basis.

It said that the sequential decline in net sales in the third quarter 2011 was driven primarily by industry seasonality as well as some impact from the current macroeconomic uncertainty, offset by the contribution from the acquired Motorola Solutions networks assets. Excluding the acquired Motorola Solutions networks assets, Nokia Siemens Networks’ net sales would have decreased 12% sequentially.

It said that the sequential decline in net sales in the third quarter 2011 was driven primarily by industry seasonality as well as some impact from the current macroeconomic uncertainty, offset by the contribution from the acquired Motorola Solutions networks assets. Excluding the acquired Motorola Solutions networks assets, Nokia Siemens Networks’ net sales would have decreased 12% sequentially.