(If you don’t receive our newsletters, by the way, you can sign up to do so here: http://www.mobileeurope.co.uk/magazine/register).

My point was that operators will do little to address the data revenue gap until they take a more nuanced approach to their core asset – network bandwidth. Shortly afterwards, a spokesperson from 3 contacted me to say that 3 UK does offer a PAYG option for its MiFi services – and could I please mention it as the 3 chaps were feeling a little left out.

So here’s a mention for 3, which sells 1Gb MiFi top-ups for £10 a time – something which I had researched (OK, clicked on their website) and knew at the time, but which I left out because it didn’t suit my argument. Actually, I left it out because this was an opinion piece about Vodafone’s strategy, not a consumer round up. But 3 are entitled to point out that they have MiFi PAYG already, although I find it slightly ironic because it could be argued that it was 3’s data pricing that started the whole race to the bottom (since halted) in mobile broadband.

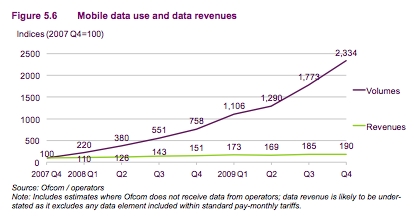

Then today, looking through Ofcom’s stats on the UK telco industry for a piece I’m writing, I found this chart.

OK, the chart itself reports that data revenues might be slightly under-reported as there’s some guesswork in there, and also data included in bundles might not show up.

But can anyone deny that this here is the general picture? Note that data revenues, by the way, have doubled over the past two years, according to that chart. It’s just that the volume operators are carrying to generate that growth has grown 20 times.

And yet… to read the last couple of sets of results from 3, you have to take a slightly more nuanced view. 3 UK, having never been profitable, is on a mission to be so by the end of this year. Due to some cost cutting, and reducing customer acquisition costs by not acquiring so many new customers, its losses are decreasing. This is despite the fact that its blended (pre and post-paid) ARPU was down 21% from 2008 to 2009, and its overall revenues down 1%. 3 itself put the ARPU decline down to MTRs (fair enough) but also to “an increase in the combined mobile broadband access customers”. ARPUs fell a further 10% in the first half of this year, by the way.

3 doesn’t necessarily mind this though, because although broadband access users generate lower ARPUs they contribute higher margins, according to 3. In other words, mobile broadband users may not be very profitable, but the margins are higher than in voice.

So it’s not all bad news, as long as you can accept profitability at the cost of growth.